Commodities

WE OFFER A LARGE NUMBER OF COMMODITIES FOR OUR CLIENTS

BSI FX offers a large number of goods to our customers. Among the popular ones are sugar, coffee, gas, and, most popular, oil.

Why do you want to trade commodities? What are they?

Throughout history, commodities have been used to keep humans in a livable world. Energy, minerals, and agriculture to preserve, build, and nourish. In today's world, home traders can also invest in goods and profit from their sales. Not only can Princes in the Gulf region be owners of crude oil, but so far you can.

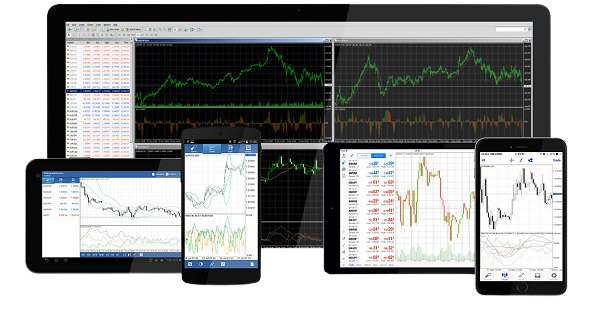

Commodities are traded on the platform, and our clients benefit from tight spreads, 24-hour access, and, most importantly, real-time market execution.

Why do you want to trade commodities? What are they?

Throughout history, commodities have been used to keep humans in a livable world. Energy, minerals, and agriculture to preserve, build, and nourish. In today's world, home traders can also invest in goods and profit from their sales. Not only can Princes in the Gulf region be owners of crude oil, but so far you can.

Commodities are traded on the platform, and our clients benefit from tight spreads, 24-hour access, and, most importantly, real-time market execution.

Commodities FAQs

What are actuals?

Actuals are the physical commodities being bought and sold.

What is a cash price of a commodity?

The cash or spot price of a commodity is the actual amount of money exchanged when commodities are purchased.

What does commodity mean?

A commodity is a physical asset, which is produced in such volume that its value can be traded on the open exchange. The price changes every day, and commodities can be bought and sold at a future date using futures contracts. Futures contracts are used because of the size and weight involved in transporting these large volumes of commodities.

How is commodity trading regulated?

In 1936, the U.S. Congress passed the Commodity Exchange Act, which governs the trading of all commodities. In 1975, the Commodity Futures Trading Commission began regulating commodity trading, replacing the Commodity Exchange Authority and the Commodity Exchange Commission established in 1936.

What is basis?

In commodities trading, the basis is the difference between a commodity’s futures price and its cash (or “spot”) price.

How do cash markets work?

Cash markets are those in which commodities are bought and sold on the “spot” or delivery. They include grain elevators, processors, over-the-counter cash trading, and commodity exchange cash trading.

What is an open commodities exchange?

There are two main exchanges for commodity trading in the United States: the New York Board of Trade (owned by Atlanta-based Intercontinental Exchange and focusing mostly on soft commodities), and the Chicago Mercantile Exchange (CME) which includes the Chicago Board of Trade (CBOT), Chicago Mercantile Exchange (CME), New York Mercantile Exchange (NYMEX), and Commodity Exchange (COMEX).

What is a breakeven selling price?

This is the price a producer, or grower, must receive for a commodity in order to cover the costs of producing that commodity.

How do futures work? What is a futures price?

Futures, sold in contracts, are sophisticated financial tools used to allow easier trading of commodities. Traders buy the commodities at a predetermined price for future delivery, which creates certainty among manufacturers of the commodity (e.g., growers). The difference between this futures price and the cash (or spot) price upon purchase, is known as the basis.

What items are considered a commodity?

Commodities are categorized by agriculture, energy, and metals. Energy commodities include crude oil and natural gas, and metal commodities include gold, silver, and copper.

Agricultural commodities include soft assets like sugar and cocoa, live animals like cattle and lean hogs, and grain commodities, such as corn, soybeans, wheat, rice, oats, and soybean oil.

Agricultural commodities include soft assets like sugar and cocoa, live animals like cattle and lean hogs, and grain commodities, such as corn, soybeans, wheat, rice, oats, and soybean oil.

Start Earning Today?

Sign Up

Sign up for an account easily, the process is very easy and very short

Fund

Deposit funds to your account, we have multiple deposit methods for your convenience

Trade

Start trading using our advanced terminals. We enabled many tools that help your trading cycle

Earn

Earn profits and withdraw anytime. Our withdrawal process takes 2 working days only